Staying Grounded in Uncertain Markets

We understand that the emotional ups and downs related to market volatility are very real—especially when headlines about tariffs, trade wars, or economic uncertainty come at you fast and unfiltered.

As financial advisors—and as fellow humans—we’ve seen what uncertainty can stir up. It’s easy to feel rattled. But it’s also a great moment to take a breath, refocus, and remember that market movement is not a flaw of the system—it’s a feature.

Why Markets Move

When tariffs or other global policy changes dominate the headlines, the markets do what they always do: react. Behind every stock market shift are millions of buyers and sellers, each trying to make sense of what the news means for the future. We are seeing this play out in real time.

A series of tariff announcements sparked sharp declines in the market, followed by further dips as other nations, including China, responded in kind. The S&P 500 saw significant losses over just a few days, while volatility spiked and investor nerves were tested. But as the dust settled, the markets—as they often do—began to stabilize.

Volatility isn’t new. In fact, it’s something we plan for. Long-term investors know that movement—sometimes dramatic—is part of the deal. It’s not just a possibility, it’s an expectation.

Volatility Isn’t the Enemy

We know it’s uncomfortable to watch the market dip, especially after a stretch of strong performance. But volatility is also what allows for growth. It’s what creates opportunity. Markets rise and fall in response to the world around us, and those movements—while unpredictable in the short term—have historically trended upward over time.

At Four Leaf, we like to remind our clients that pullbacks and corrections aren’t necessarily a signal to act—they’re often a reminder to pause, reflect, and stay the course.

Timing the market—trying to guess when to jump in or out—is incredibly difficult, even for professionals. Often, the biggest gains come right on the heels of the biggest drops. Missing just a few of those strong days can have a significant long-term impact.

Staying Invested Matters

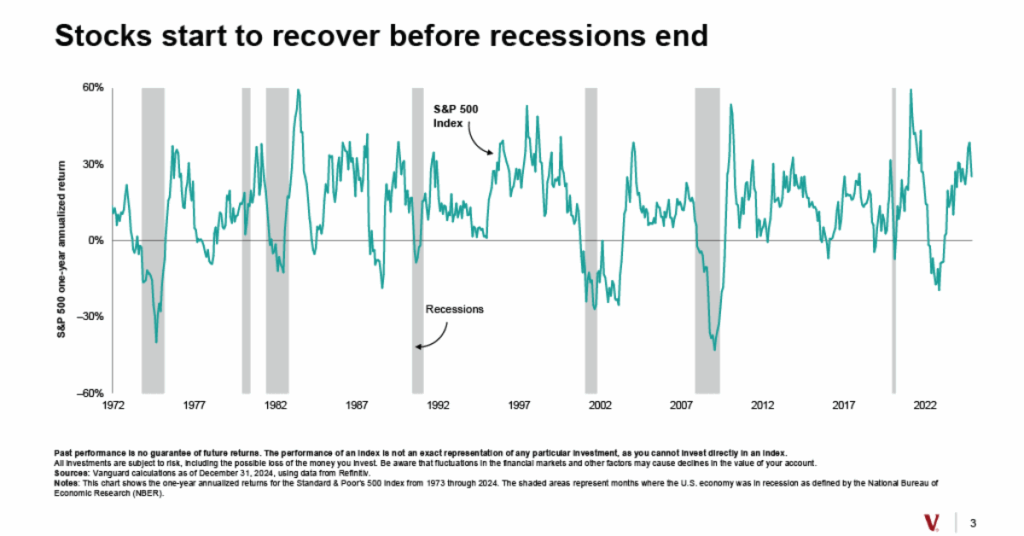

Imagine selling everything during a downturn to “wait it out.” Sounds reasonable, right? But the recovery often begins before you feel ready to re-enter. That means you could miss the rebound entirely. That’s why we encourage our clients to stick to their plan, even when the markets feel anything but predictable.

History backs this up. Markets have recovered from wars, recessions, pandemics, and political upheaval. Short-term discomfort has almost always given way to long-term growth. Staying invested, especially in a portfolio built around your goals and risk tolerance, is one of the best decisions you can make.

Your Portfolio Is Built for This

When we designed your portfolio, we knew days like this would come. That’s why it includes a mix of different asset classes—stocks, bonds, global exposure, and more. Diversification helps spread risk and cushion against volatility. While one part of your portfolio might dip during a downturn, another part might hold steady or even gain.

That’s not by accident. It’s by design.

And while we can’t prevent the markets from fluctuating, we can work with you to ensure your plan is built to withstand those fluctuations without losing sight of your long-term goals.

Looking Forward

Markets are inherently forward-looking. That means prices today reflect expectations for the future. Sometimes that leads to quick, dramatic moves based on developing stories—like changes in trade policy or global economic shifts.

SOURCE: Vanguard, Inc.

But those movements don’t always have lasting consequences. Historically, even during periods of stagflation (a combination of slowing economic growth and rising prices), markets have delivered positive returns more often than not. And even in the face of recessions, long-term investors who stayed invested have often been rewarded for their patience

We’re Here for You

We know it’s not easy to stay calm when the headlines are loud, and the numbers are flashing red. That’s why we’re here—not just to build your financial plan, but to walk with you through seasons of uncertainty.

If you’re feeling anxious, unsure, or just want to talk about how this all fits into your bigger picture, let’s connect. We’re happy to revisit your plan, run the numbers, and make sure you’re still on track. Spoiler alert: You probably are.

We’re here to listen, to guide, and to remind you that this journey—like all journeys—goes best with a steady hand and a clear head.

Sources:

Vanguard, Inc. “Market Volatility,” 2025 update

Dimensional Fund Advisors, “Tariffs and Stagflation,” February 21, 2025

National Bureau of Economic Research, “Business Cycle Dating”

Investment advisory services provided by Forefront Wealth Partners, LLC. Forefront also markets advisory services under the name, Four Leaf Financial Planning. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful, or that markets will act as they have in the past.

We understand that the emotional ups and downs related to market volatility are very real—especially when headlines about tariffs, trade wars, or economic uncertainty come at you fast and unfiltered.

As financial advisors—and as fellow humans—we’ve seen what uncertainty can stir up. It’s easy to feel rattled. But it’s also a great moment to take a breath, refocus, and remember that market movement is not a flaw of the system—it’s a feature.

Why Markets Move

When tariffs or other global policy changes dominate the headlines, the markets do what they always do: react. Behind every stock market shift are millions of buyers and sellers, each trying to make sense of what the news means for the future. We are seeing this play out in real time.

A series of tariff announcements sparked sharp declines in the market, followed by further dips as other nations, including China, responded in kind. The S&P 500 saw significant losses over just a few days, while volatility spiked and investor nerves were tested. But as the dust settled, the markets—as they often do—began to stabilize.

Volatility isn’t new. In fact, it’s something we plan for. Long-term investors know that movement—sometimes dramatic—is part of the deal. It’s not just a possibility, it’s an expectation.

Volatility Isn’t the Enemy

We know it’s uncomfortable to watch the market dip, especially after a stretch of strong performance. But volatility is also what allows for growth. It’s what creates opportunity. Markets rise and fall in response to the world around us, and those movements—while unpredictable in the short term—have historically trended upward over time.

At Four Leaf, we like to remind our clients that pullbacks and corrections aren’t necessarily a signal to act—they’re often a reminder to pause, reflect, and stay the course.

Timing the market—trying to guess when to jump in or out—is incredibly difficult, even for professionals. Often, the biggest gains come right on the heels of the biggest drops. Missing just a few of those strong days can have a significant long-term impact.

Staying Invested Matters

Imagine selling everything during a downturn to “wait it out.” Sounds reasonable, right? But the recovery often begins before you feel ready to re-enter. That means you could miss the rebound entirely. That’s why we encourage our clients to stick to their plan, even when the markets feel anything but predictable.

History backs this up. Markets have recovered from wars, recessions, pandemics, and political upheaval. Short-term discomfort has almost always given way to long-term growth. Staying invested, especially in a portfolio built around your goals and risk tolerance, is one of the best decisions you can make.

Your Portfolio Is Built for This

When we designed your portfolio, we knew days like this would come. That’s why it includes a mix of different asset classes—stocks, bonds, global exposure, and more. Diversification helps spread risk and cushion against volatility. While one part of your portfolio might dip during a downturn, another part might hold steady or even gain.

That’s not by accident. It’s by design.

And while we can’t prevent the markets from fluctuating, we can work with you to ensure your plan is built to withstand those fluctuations without losing sight of your long-term goals.

Looking Forward

Markets are inherently forward-looking. That means prices today reflect expectations for the future. Sometimes that leads to quick, dramatic moves based on developing stories—like changes in trade policy or global economic shifts.

We understand that the emotional ups and downs related to market volatility are very real—especially when headlines about tariffs, trade wars, or economic uncertainty come at you fast and unfiltered.

As financial advisors—and as fellow humans—we’ve seen what uncertainty can stir up. It’s easy to feel rattled. But it’s also a great moment to take a breath, refocus, and remember that market movement is not a flaw of the system—it’s a feature.

Why Markets Move

When tariffs or other global policy changes dominate the headlines, the markets do what they always do: react. Behind every stock market shift are millions of buyers and sellers, each trying to make sense of what the news means for the future. We are seeing this play out in real time.

A series of tariff announcements sparked sharp declines in the market, followed by further dips as other nations, including China, responded in kind. The S&P 500 saw significant losses over just a few days, while volatility spiked and investor nerves were tested. But as the dust settled, the markets—as they often do—began to stabilize.

Volatility isn’t new. In fact, it’s something we plan for. Long-term investors know that movement—sometimes dramatic—is part of the deal. It’s not just a possibility, it’s an expectation.

Volatility Isn’t the Enemy

We know it’s uncomfortable to watch the market dip, especially after a stretch of strong performance. But volatility is also what allows for growth. It’s what creates opportunity. Markets rise and fall in response to the world around us, and those movements—while unpredictable in the short term—have historically trended upward over time.

At Four Leaf, we like to remind our clients that pullbacks and corrections aren’t necessarily a signal to act—they’re often a reminder to pause, reflect, and stay the course.

Timing the market—trying to guess when to jump in or out—is incredibly difficult, even for professionals. Often, the biggest gains come right on the heels of the biggest drops. Missing just a few of those strong days can have a significant long-term impact.

Staying Invested Matters

Imagine selling everything during a downturn to “wait it out.” Sounds reasonable, right? But the recovery often begins before you feel ready to re-enter. That means you could miss the rebound entirely. That’s why we encourage our clients to stick to their plan, even when the markets feel anything but predictable.

History backs this up. Markets have recovered from wars, recessions, pandemics, and political upheaval. Short-term discomfort has almost always given way to long-term growth. Staying invested, especially in a portfolio built around your goals and risk tolerance, is one of the best decisions you can make.

Your Portfolio Is Built for This

When we designed your portfolio, we knew days like this would come. That’s why it includes a mix of different asset classes—stocks, bonds, global exposure, and more. Diversification helps spread risk and cushion against volatility. While one part of your portfolio might dip during a downturn, another part might hold steady or even gain.

That’s not by accident. It’s by design.

And while we can’t prevent the markets from fluctuating, we can work with you to ensure your plan is built to withstand those fluctuations without losing sight of your long-term goals.

Looking Forward

Markets are inherently forward-looking. That means prices today reflect expectations for the future. Sometimes that leads to quick, dramatic moves based on developing stories—like changes in trade policy or global economic shifts.

SOURCE: Vanguard, Inc.

But those movements don’t always have lasting consequences. Historically, even during periods of stagflation (a combination of slowing economic growth and rising prices), markets have delivered positive returns more often than not. And even in the face of recessions, long-term investors who stayed invested have often been rewarded for their patience

We’re Here for You

We know it’s not easy to stay calm when the headlines are loud, and the numbers are flashing red. That’s why we’re here—not just to build your financial plan, but to walk with you through seasons of uncertainty.

If you’re feeling anxious, unsure, or just want to talk about how this all fits into your bigger picture, let’s connect. We’re happy to revisit your plan, run the numbers, and make sure you’re still on track. Spoiler alert: You probably are.

We’re here to listen, to guide, and to remind you that this journey—like all journeys—goes best with a steady hand and a clear head.

Sources:

Vanguard, Inc. “Market Volatility,” 2025 update

Dimensional Fund Advisors, “Tariffs and Stagflation,” February 21, 2025

National Bureau of Economic Research, “Business Cycle Dating”

Investment advisory services provided by Forefront Wealth Partners, LLC. Forefront also markets advisory services under the name, Four Leaf Financial Planning. Content provided herein is for informational purposes only and should not be used or construed as investment advice or a recommendation regarding the purchase or sale of any security. There is no guarantee that the statements, opinions or forecasts provided herein will prove to be correct.

Past performance may not be indicative of future results. Indices are not available for direct investment. Any investor who attempts to mimic the performance of an index would incur fees and expenses which would reduce returns.

Securities investing involves risk, including the potential for loss of principal. There is no assurance that any investment plan or strategy will be successful, or that markets will act as they have in the past.